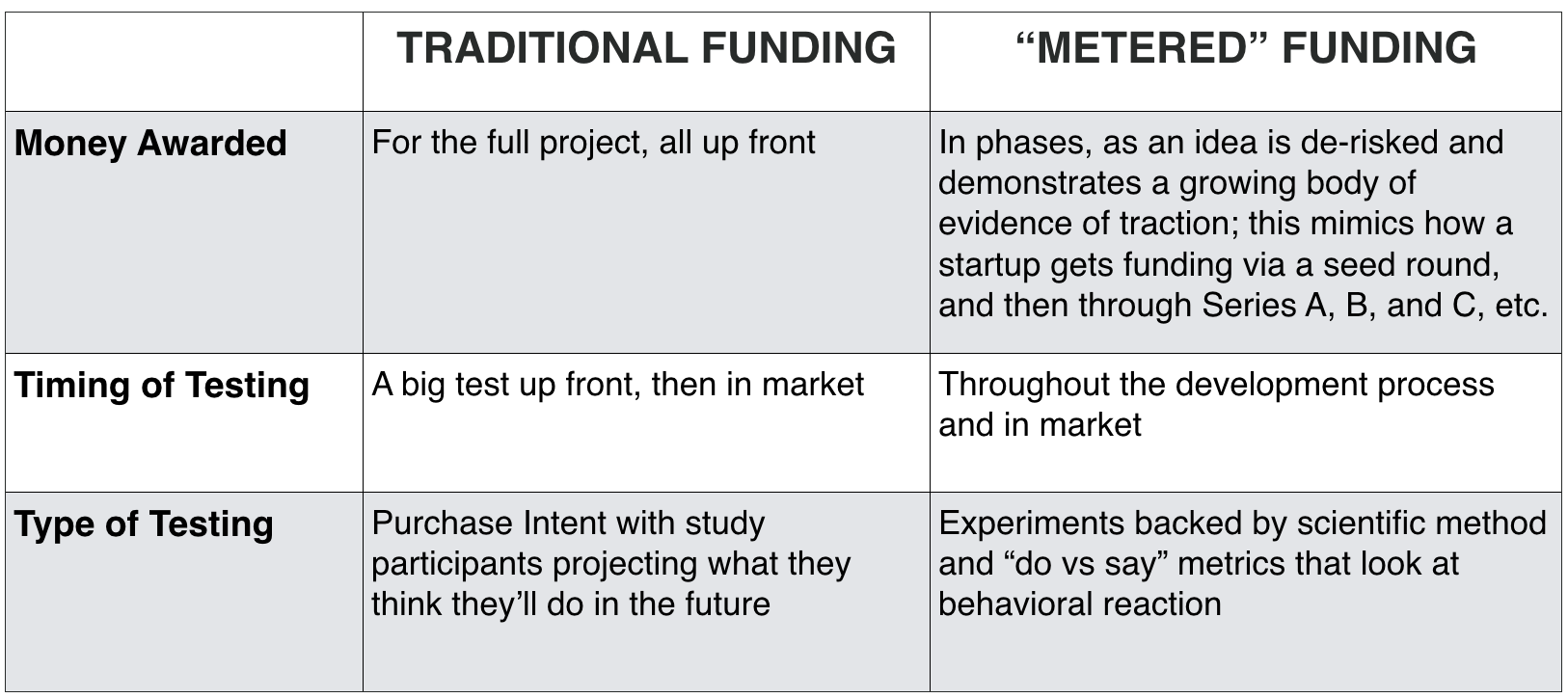

Traditionally in BigCos, teams receive a large budget for the full project up front, but this budget is allocated before the idea is even proven to be one that should go to market.

In contrast, startups’ budgets only grow as their idea has less risk and gains more traction. Startup teams are hustling to de-risk their idea and make it as viable as it can be every step of the way in order to get more funding. They’re operating with an incredible amount of ownership and urgency.

How do you accelerate investment as you gain confidence in the idea through validated learning, and therefore, only invest larger budgets in high viability ideas? How do BigCos unlock that sort of behavior and mindset? What else needs to be true to in order for BigCo teams to do so?

Many BigCo teams are leveraging Lean Startup to begin to solve for this, but when leveraged in the traditional funding setting, it is like you’re applying the scientific method without urgency or incentivization. This is where metered funding starts to come in.

“We need to realize that the goals of scientists and entrepreneurs are not the same. The pursuit of raw knowledge is a scientific pursuit. In that realm, learning is truly the measure of progress. But entrepreneurship is goal driven. Empirical learning is a part, but not all, of the final goal: to build a repeatable and scalable business model before running out of resources. While empirical learning is a key part of that process, unless you can quickly turn that learning into measurable business results, you are just accumulating trivia.” – Ash Maurya, Scaling Lean

Metered funding mimics the way that many startups receive funding from Venture Capitalists, driving teams to prove the desirability, viability, and feasibility of their ideas over time, and only awarding funding accordingly. It is a mindset

The idea of Lean Startup and conducting rapid testing and iteration loops in isolation is helpful to BigCos. But that alone—without changing the incentivization structure and the way that funding is allocated—isn’t as effective as bringing metered funding online to drive deeper behavior change.

Metered Funding vs. Traditional Funding

With traditional funding, teams and projects are typically funded with an allocated budget for a set period of time (usually annually). With metered funding, ideas are allocated funding over a series of rounds and are based on goals and milestones. The benefit of metered funding is that in the earlier rounds, funding is learning-based, and in the later rounds, funding is growth-based.

Many teams leverage “growth boards” in tandem with metered funding. A growth board is a dedicated team of decision influencers that help make quick, clear decisions on projects. The combination of a growth board and utilizing metered funding allows teams to quickly learn on ideas and make the pivot, perish, persevere decisions.

BigCo leaders should be asking themselves, “What would it take to pilot metered funding on an initiative? Would it change future mindsets and behaviors?”

We heard a few examples of BigCos actioning metered funding at the 2018 Lean Startup Conference:

Zappos gives teams small budgets to go try things; they earn the right to go build out the ideas more if they can show early progress.

Haier has 4,000 mini teams that each get their own P&L; the teams earn funding by showing evidence through experiments over time.

Handelsbanken’s decentralized banks each have freedom to go do their own experiments, earn more funding.

Buurtzorg Netherlands has 14,000 nurses organized in teams with the autonomy to figure out care for their patients and decide what’s most effective resulting in beating their competitors on every metric.

In The Startup Way, Eric Ries emphasizes a variety of benefits for this model, some of which include lowered political burdens for the teams and a focus on asking, “What do I have to provably learn in order to unlock more funding?”

“Innovation without constraints is no blessing – startup mortality rates are unusually high for overfunded projects, with many infamous examples.” – Eric Ries, The Startup Way

But in his closing remarks at Lean Startup Conference 2018, Ries commented on the common pitfalls that teams run into when implementing. He shared his observation on how even when teams want to use these approaches, they can’t help but go from a small budget to full scale, instead of truly allowing validated learning to drive investment decisions across the portfolio.

We highly recommend that teams adopt metered funding, but NOT in isolation. Metered funding alone won’t likely cause org behavioral change all on its own, but in tandem with other things like growth boards, dedicated project teams, and evolving mindsets and leadership tactics, change can happen. To fully maximize an approach like metered funding, teams need to unlock hustle: fully embracing the key entrepreneurial skills and mindsets required to truly activate the power of Lean Innovation capability within their organizations.

Still, if teams can’t yet implement any of these changes, first, a mindset shift is key.

Teams can begin by mentally treating their budgets like this at various stages of initiative development, which helps step out of the traditional model and into systematically de-risking ideas with bigger and bigger audiences and higher prototype fidelity.

Leaders too can begin acting more like they are on growth boards rather than directing the project. They can coach to enable learning and decisions, asking questions like, “What have you learned, and what else do you need to learn?”